Living with taxes

•

by

•

by Sweet Drinker

Today is a good day for an article because there are examples of just about everything I wish to discuss available.

As you know weapons have spent basically a full day at the new 15% VAT rate.

What has been the result of this, and how should you respond?

Well firstly: have prices risen?

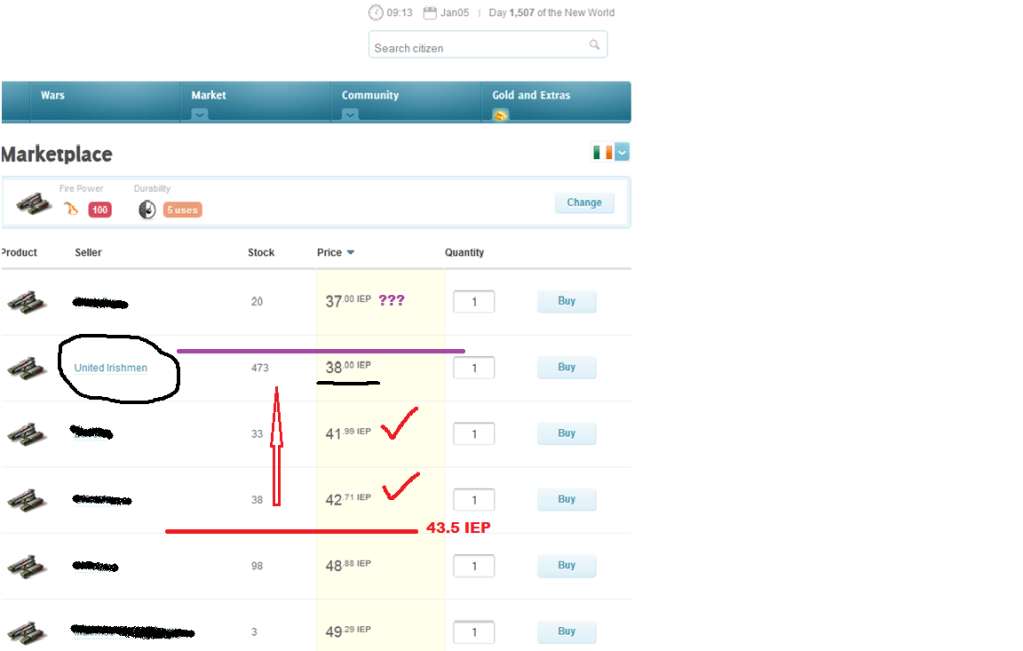

As you can see, mkt prices of Q5 weapons have maintained the same price levels they were at when VAT was 1% : 38IEP

But let's pick apart the diagram above:

You'll Notice United Irishmen has a large offer up at exactly 38IEP

That's because United Irishmen is acting as a subsidary of the treasury.

We intend to always have such an offer up (it might be soldout for brief periods)

Now further down the diagram you'll see a red line with 43.5IEP next to it.

That's our 'buy line'. This represents the pre-tax-hike price + the new tax.

As you can see, the offers between our offer and the buy line are checkmarked. That's because we can buy up those offers, write off the taxes to the treasury, and resell them to the public for 38IEP.

And that's exactly what we do, buy them off Irish ppl, and sell them to Irish ppl for cheaper. As long as we don't buy anything below the buy line, the government doesn't lose any money (except potential tax revenue ofc).

Offers below the buy line are more expensive than the new tax level would imply (sometimes ridiculously so). So we don't buy them.

Notice the purple line now. This fellow has placed an offer lower than ours.

There is nothing wrong with that, if he can make a profit selling for lower than our offer, fairplay to him, and great news for the buyer!

However what needs to be clear to everybody is:

You do not need to compete against our offers. If your going to lose money by undercutting the bank, don't do it! As long as your price falls within the buy line, you're stuff is gonna sell.

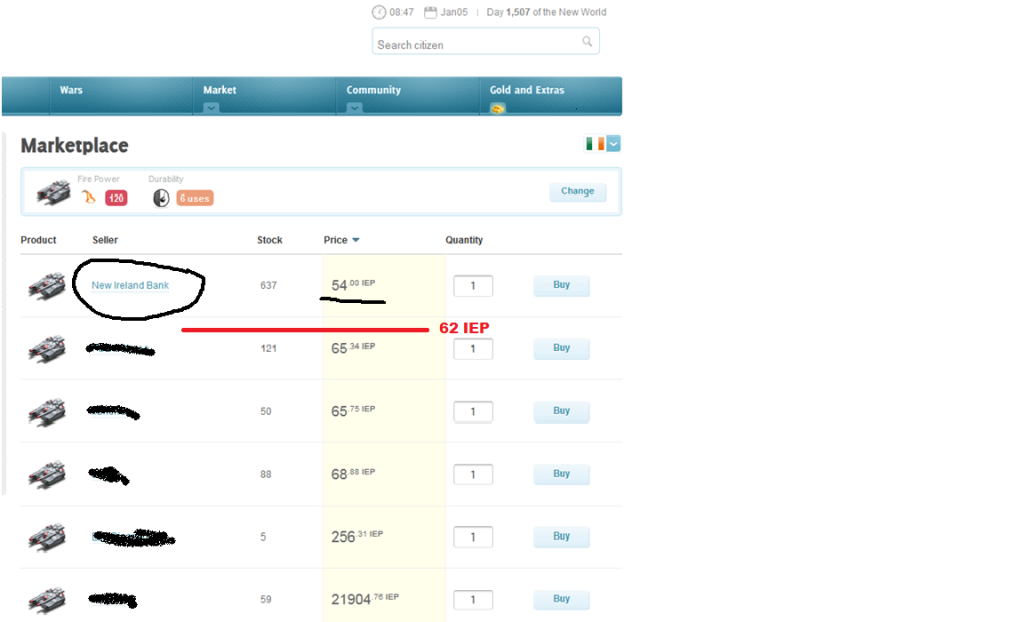

Now here we have the Q6 market:

Notice that the price of Q6 weapons is also fixed at what is was when VAT was 1%. And quite obviously it is the bank doing so.

But you may notice a problem on this market: there are no other offers within the buy line.

Now this isn't a big problem for us, we can import them from ally markets

(Those particular Q6's were actually purchased from a prominent Irish producer).

However a savvy investor might realize that this presents an opportunity:

If you were to say, buy some Q6's from America and place them on the Irish market within the buyline.. it's pretty obvious what would happen

😉

It should be made clear: this works just as effectively if the VAT rate was 25%. The buy line will just be adjusted to include the increased rate.

Now you maybe are wondering 'what about Q1-4 weapons?'.

Sadly the answer is, we're ignoring them.

The fact is that weapons are an undynamic market. Regardless of prices, a Q5 weapon will always be intrinsically better than a Q2 weapon.

It is true that citizens occassionally buy a small amount of low quality weapons. However, not enough of them to have a serious impact on our nation's capabilities (not compared to the potential impact of the extra tax revenue). With high VAT and subsidy only on high quality levels, most likely low quality level weapons will lose the (very slight) cost advantage they previously had.

If your concerned about low quality weapons co owners' sales: 'Somebody' will buy them. But it won't be us. So it make take awhile.

About Foo

😛

Food is a dynamic market. Since there is no intrinsic difference between food qualities, any Qlevel has the potential to be the best value for purchasers.

I feel that a dynamic market should be left alone if possible.

The Future:

I feel eIreland should take full advantage of the potential on the weapons market. 25% VAT really can be effectively implimented without our nation sufferring any considerable loss, and there is truly so much to gain.

Food taxes on the other hand should be minimized for several reasons.

It's a dynamic competitve market.

Young citizens most cost effectively increase their dmg with food.

We don't need it, weapons generate loads of revenue.

It's worth noting that our Q6 weapon prices don't conform to international trends.

USA:

26.8 Q6/gold

31.5 Q5/gold

CNY:

26.1 Q6/gold

31.2 Q5/gold

BRL:

26.9 Q6/gold

31.5 Q5/gold

IEP

21.1 Q6/gold

30 Q5/gold

Obviously our nation lacks the production bonuses of these other countries so we should expect to pay more than they do.

However discrepancy of purchasing power between Q5 and Q6 weapons is not in line with global trends.

Irish goods are overpriced, but Q6 weapons are over-overpriced!

In the long term we hope normalize this discrepancy. However that is not realistic at this time.

I know this was article was tediously long.

Thank you for taking the time.

Comments

I'm glad you enjoy shutting down businesses like mine. I hope you gain great wealth for our nation by doing this, so a politician can syphon it later to great personal wealth for themselves.

Great article, Sweet. You should publish more like these, very helpful.

Interesting read. Mostly understand - does set up the political debate of Free market vs Gov regulated though. A lovely debate which hopefully comes up.

I wanna know, why are Irish jobs pay so little compared to other countries? 80 IEP (when 1 IEP = 0.001 G), some countries have 4x that.

Excellent plan and I fully support

Bhane

That's exactly the sort of 'omfg we're ruooined' comment that spurred me to make my previous article

Anybody with a few minutes of free time can calculate a CO's projected probable margin.

Should I respond to your comment by posting your projected daily profit margins here in public for everyone to see? Would it be so easy to plead poverty then?

fully supported!

And for the recor😛 When I said

'Those particular Q6's were actually purchased from a prominent Irish producer'

I was ofc referring to Bhane.

We bought almost 800 Q6 guns from Bhane

At Bhane's chosen listed price

IN 24 HOURS

However when the 10% tax increase went into effect,

Bhane's prices rose 20.018%

If there is a justification for raising prices by DOUBLE the tax adjustment, I'd like to hear it.

Good article. Yeah, this definitely could be a very effective way of doing things. I'm still pretty skeptical because in general I'd fully advocate a mostly free market. But in this case it's likely this could work very well.

sweet is clearly just a genius, there's simply Notting else to be said.

fully supported..

Excellent article, explained the plan in a straight forward fashion.

V

Full support here. Great article explaining everything and backs up all your points on the matter of the vat change.

Excellent stuff o/

Just to be clear the bank and it's apparent subsidiary (United Irshmen) do not pay VAT. All the tax is sent to the treasury. They are paying the VAT to themselves. In essence the bank is taxing the competition and gets a price advantage in the market.

Feel free to calculate with all the made up numbers you want. I run my companies below zero profit margin. I actually buy a minor amount of gold to cover the losses in my companies. You know this is true, so don't try to spin a lie about me being a profiteer.

I don't expect my tanks to sell at their current price. I am actually pricing them just beyond market value just as a buffer against inflation. With wages going down, It would be nice to see tanks go down into the 40's. I actually had a plan to work prices down to the 40's over the next month, but you've put the kibosh on that.

I told ye eejits sweet was a genious, just settle down and let the man do his thing so Ireland can continue to be the most successful country of it's size in the game.

Haha sweet, what the hell are you doing?

You showed lots of economic talent in the past, but this scheme is quite terrible. Sort of reminds me of the EU agricultural policy in its worst days.

You are gonna end up with tons of tanks, paid for by tax money, and nobody buying them at the price you projected.

It's the same price they were paying before Starkad.

Why would they stop now?

Alrite Bhane I'll field that comment : )

--The Bank does not pay VAT because it's paying the VAT to itself--

100% true. When the bank buys or sells, the tax portion of the purchase goes through the treasury back to itself. That is why it's able to buy items from Irishmen for more than it sells them for without losing money.

Protecting Irish consumers from taxes.

--I run my companies with zero profit margin--

Are you saying when we bought out your entire stock at the price you had it listed for.. you lost money?

If your deliberately losing money, I don't see how (or why) anyone should stop you.

--I actually had a plan to work prices down to the 40's over the next month--

"In the long term we hope normalize this discrepancy. However that is not realistic at this time."

Sounds very similar I think.

VAT is 15times higher than it was 9days ago before it was raised from 1%

Not only is the bank holding prices to within 20cent of what they were then, Irish suppliers are actually undercutting the government benchmark.

Where do they find the margin?

I genuinely hope this all goes well, Sweet. I truly wish that you guys you guys are able to assuage my fears, and prove my doubts wrong.

Sweet,

with "they", are you referring to the bot, or the general market?

I don't understand 🙁

Tax raises aside , u gotta love sweets double standards, gives out because as he says original tax rates were discussed and held to rate because of a small number of people then he comes along and uses a smaller number ie Himself to determine Irelands tax future, and raises tax by "shouts " .

Nice work sweet , btw dont bother posting some witty retort , i dont come back to articles after commenting these days : )

^ just waves his dick, then off to IRC to boast of how much fun he is having! SO MUCH FUN

Comments aren't just for the benefit of 2 people , that's what PMs are for. I will be coming back to this article and I think I speak for everyone in the audience when I say I want to hear Sweets witty retort.

Sweet I'll play it your way and see how it goes--put my product up within your line. Not sure where you are getting your numbers but a quick check of US Q6 weapons showed less than 15 Q6/gold they run at 1 US dollar = .002 gold and they are selling Q6s in the 40"s which would me more than 80 IEP.

You think YOU'VE got standards?

Well Castaneda says I have DOUBLE standards.

That's over 3 TIMES as much standards as you've got!

Mardel:

Don't buy USD, sell gold. Then those figures will make sense

(with a slight discrepancy due to price fluctuation)

Thanks for the time and effort sweet it's appreciated!

A good system, will just take a while for some people to realise that it does work, and with a bit of thought they could use it to their advantage!! and actually will be as well if not better off.

Mind you there will always be those that want more than a reasonable amount of profit per day, and these people will never be happy and continue to stir unrest.

If anyone says they can't make money under this system send me your costings/figures to prove it.

Another cunning plan......

OMG. you will end with bunch of tanks at mad price. people will start trading through pm not on market. in my opinion there is lots of mistakes in your plan:

demand- supply chain broke as you invented market regulation. old people will start working abroad as even today they can buy 8 q6 tanks in brasil for day job. weak players will lose interest in eireland as they cant afford to buy any weapons and do damage. no new players will come to eireland. people must be able to earn money, to invest (extra tutorials should be placed) into industry. teach people to earn more money by upgrading companies to sell more profitable product. i know that were missing production bonuses, it means that we need more people to reach same level as others have. need more players not more taxes. as i see there is only way to rise this country is export and only export, but on 25% tax its just impossible. (((((((( thats my stupid guess, dont take it for real 🙂 (((i hope this will not happend, but in 2-5 days monetary market will be flooded with iep for sale, gold should be wavy 100iep+ and in best case(for few days) stay at1250, worsest scenario iep at 0.002, but this will not happen as we will not stop fighting and buying tanks, will we?))))))

>Don't buy USD, sell gold

Key.

It seems you've hit on a great way to play the game mechanics and get some extra $$ for eIreland, well done!

I imagine that buying and offering products on behalf of the government is only a small fraction of the overall workload of this initiative, bearing in mind you'll have to keep a close eye on 'buybot VAT income' vs state expenditure (especially on how much IEP is being re-circulated) to avoid inflation. Not to mention regularly checking the wage/production/revenue levels to ensure that running a company and working each day remain consistenly viable!